Global News Summary 21-26 April 2025

This week saw markets balance between hope for de-escalation and fear of prolonged trade headwinds

United States

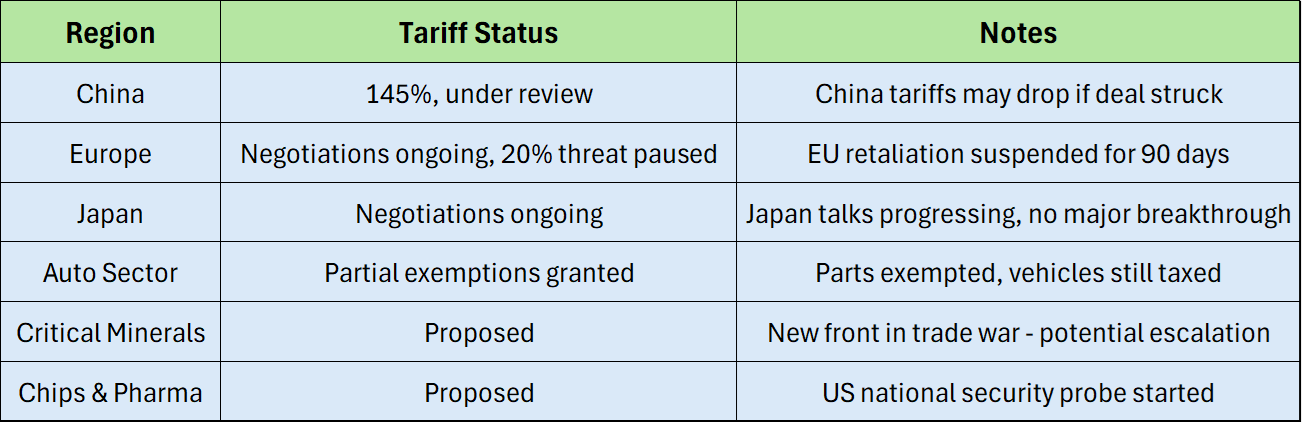

Trump & Tariffs:

Trump said there would “100%” be a US-EU trade deal after meeting Italy’s PM Meloni.

Trump threatened new tariffs on China but signalled reluctance to escalate further, citing trade slowdown risks.

On 24 April, Trump paused car part tariffs after lobbying from auto executives but said China tariffs (currently 145%) could adjust "in 2–3 weeks."

Federal Reserve:

Trump insisted he has "no intention" to fire Powell after earlier reports spooked markets.

Tensions persist after Trump's attacks on Fed independence were criticised by GOP Senator John Kennedy and French Finance Minister Lombard.

New Probes:

US launched national security probes into chips and pharma goods, opening new fronts for potential tariffs.

Market Impact:

Wall Street rebounded midweek on hopes of trade deal progress.

However, inflation concerns persist as Trump tariffs are viewed as “transition problems” by Trump himself.

Key Figures:

Consumer sentiment plunged to one of its lowest on record.

US GDP growth forecast for 2025 downgraded to 1.4% (from 2.0%), recession odds raised to 45%.

United Kingdom

Chancellor Reeves:

In Washington, Reeves pushed for freer UK-US trade and tariff relief on cars and steel.

Reeves rejected wealth tax increases despite worsening UK fiscal pressure.

Economic Pressure:

Public borrowing overshot by £15bn; private sector activity contracted at its fastest pace in two years.

BOE's Bailey warned Trump's tariffs risked further slowing growth, signalling a rate cut likely soon.

IMF cut UK growth forecasts, and BOE policymaker Megan Greene warned tariffs could drag prices lower, not higher.

Europe (Eurozone)

Trade Response:

EU suspended immediate retaliation on US steel/aluminium tariffs for 90 days, seeking a "win-win" solution.

ECB’s Villeroy de Galhau called Trump's global tariff approach a "lose-lose game."

Macroeconomic Strain:

Eurozone business confidence fell sharply to 50.1 in April (from 50.9).

ECB officials, including Lagarde and Villeroy, signalled flexibility and hinted at more rate cuts ahead

Japan

Tariff Negotiations:

PM Ishiba said Japan won’t endlessly concede in US trade talks.

Talks began, with early signs that auto parts and agriculture would dominate the agenda.

Economic Impact:

March CPI (ex-food) rose 3.2% YoY, supported by surging rice prices (+92.1% YoY).

BOJ watchers now expect slower pace of rate hikes due to trade war risks.

China

Trade Moves:

China expanded fiscal spending (9.26 trillion yuan in Q1) to defend the economy.

Chinese e-commerce giants (Alibaba, JD.com, Pinduoduo) launched programmes to boost domestic consumption.

Diplomacy:

Xi Jinping intensified outreach in Southeast Asia.

China prepared to lift sanctions on European lawmakers to revive EU investment ties.

Tariff Outlook:

China pushing back against 145% US tariffs; talks remain tentative.

Corporate Highlights

Company News Apple Accelerating shift of iPhone production to India. Nvidia Facing $5.5bn sales hit from US export restrictions to China. Intel CEO warned of structural issues. T-Mobile US Missed subscriber growth targets. AbbVie Raised profit guidance, flagged trade risks.

Market Snapshot for the Week

Asset Class Weekly Performance

S&P 500 +0.7% Nasdaq 100 +1.1% Dow Jones Flat

Euro Stoxx 50 +0.5% Nikkei 225 +1.0%

US Dollar Index +0.2% Euro -0.2% to $1.1363 Pound Sterling -0.2% to $1.3320 Yen -0.7% to 143.64

Bitcoin +2.1% to $95,404 Gold -1.3% to $3,305/oz WTI Crude +0.6% to $63.19/bbl

US 10Y Yield -6bps to 4.26%

Weekly Asset Performance 21-26 April 2025

Strategic Takeaways

Markets show resilience, but tariff uncertainty weighs on confidence.

Fed action: Market increasingly expects rate cuts by second half of 2025.

Trade headlines dominate daily volatility.

Capital flight to Eurozone shows stress in US asset markets despite stock gains.

Recession risk continues to rise, with consumer sentiment flashing major warning signals.