Global News Summary: 15–20 September 2025

Executive Summary

Markets ended the week on a bullish note as the Fed cut rates by 25 bps and signaled more to come, pushing the S&P 500 above 6,660 to fresh record highs. Tech led gains, but small caps lagged, hinting at uneven breadth. Core macro signals remain mixed: US GDP is strong, but exports and jobs show stress. The dollar fell to its lowest since March 2022, gold hit $3,684/oz, and bond markets priced in two more cuts this year. Political risks in Europe (French government collapse) and UK gilt yield spikes add complexity. AI and tech infrastructure flows remain dominant themes, with US giants committing tens of billions to UK and global data centers.

Equities & Growth

US:

S&P 500: +0.5%, Nasdaq 100: +0.7%, Dow Jones: +0.4%, Russell 2000: –0.8%

Triple-witching drove 27.7B shares traded, 3rd-busiest day since 2008.

GDP: Revised to 3.3% annualized Q2, fueled by domestic demand and real final sales.

Europe:

Euro hit 4-year highs vs USD ahead of Fed cut.

France’s PM Bayrou lost confidence vote, spiking OAT-Bund spreads to multi-month highs.

UK:

Gilt yields surged (30Y near 5.43%).

Wage growth +4.7% YoY, pointing to higher state pension costs in 2026.

Japan:

GDP expanded 2.2% annualized (est. 1%), consumption revised higher.

LDP leadership race now includes Shinjiro Koizumi, yen volatility elevated.

China:

Retail sales +3.4% YoY (below 3.9% consensus).

Industrial production +5.2%, showing resilience despite US tariffs.

Jobs & Labor

US:

August NFP +22k, June revised negative — first job loss since 2020.

Jobless rate rose to 4.3%.

Fed cited labor market weakness as primary reason for resuming cuts.

UK:

Unemployment expected to hit 5% by Aug quarter; hiring slowed on higher employer NI contributions.

NZ:

GDP –0.9% Q2 vs +0.9% prior; RBNZ likely to cut further.

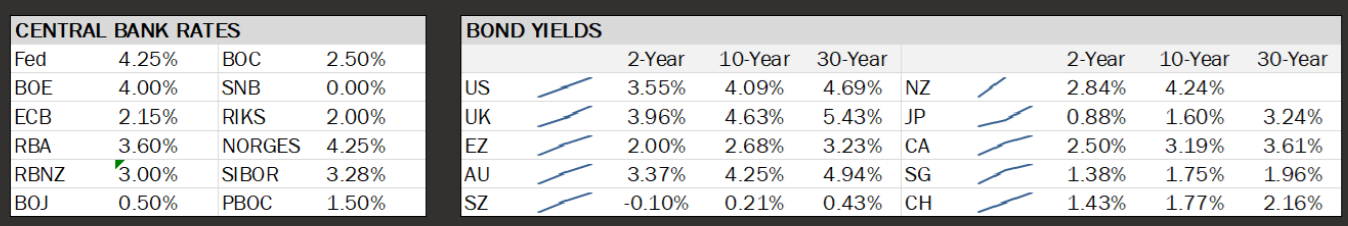

Central Bank Rates and Government Bond Yields

Rates & Yields Snapshot

Central Bank Rates Key Observations

Fed: 4.25% First cut in months, markets price 2 more cuts this year.

BOE: 4.00% Sticky 3.8% inflation may keep BOE cautious.

ECB: 2.15% Balanced risk stance, watching US tariffs.

RBA: 3.60% Holding steady as consumption holds.

RBNZ: 3.00% Market pricing steeper cuts post-GDP contraction.

BOJ: 0.50% Expected to hold, but speculation persists for hike by year-end.

Bond Yields 2-Year 10-Year 30-Year Commentary

US 3.55% 4.09% 4.69% Curve steepened post-cut, markets cautious.

UK 3.96% 4.63% 5.43% Highest since late 1990s, fiscal concerns rising.

EZ 2.00% 2.68% 3.23% Stable despite France’s political turmoil.

AU 3.37% 4.25% 4.94% Rising yields may restrain RBA.

NZ 2.84% 4.24% – Cuts priced in aggressively.

JP 0.88% 1.60% 3.24% Long-end yields up; BOJ under pressure.

CA 2.50% 3.19% 3.61% BOC just cut 25 bps, bonds remain tight.

AI & Technology

US & UK:

Microsoft, Nvidia, Google, OpenAI to invest tens of billions in UK compute infrastructure.

Apple iPhone 17 Pro & Air launch saw strong demand.

OpenAI to produce first in-house chip with Broadcom next year.

Anthropic halts services to Chinese SOEs, first such move by a US AI company.

China:

Trials of first domestic AI chip production equipment underway.

ByteDance, Alibaba ordered to cease Nvidia RTX Pro 6000D orders.

Inflation & Policy

US:

CPI 2.9% YoY, Core 3.1%, PPI 2.6% YoY — disinflation trend intact but sticky services.

Powell warns against expecting “rapid series” of cuts.

UK:

CPI steady at 3.8%; services inflation stubborn.

EZ:

Aug CPI 2.1%, above ECB’s 2% target.

Japan:

Tokyo CPI eased to 2.5%, but BOJ still signaling readiness to hike.

Macro Risks & Recession Watch

Yield curves remain steep in the UK and flattening in the US — signaling policy uncertainty.

Recession risks shifting from inflation-driven to labor-driven.

AI sector still soaking up capital flows, but Jack Selby warns of potential “biggest bubble yet” in private tech valuations.

Forward Look — September & Beyond

US Payrolls (Oct 4): Key trigger — another weak print could open door to 50bps cut in November.

US CPI (Oct 11): Watch for services cooling to sustain rally.

Europe: Sep 8 French vote fallout still weighs; OAT-Bund spread to be monitored.

China: More targeted stimulus likely if retail sales keep missing.

AI Earnings: Nvidia, Dell, and hyperscalers in focus as infrastructure demand faces tariff headwinds.

Bottom Line:

The post-Fed rally shows investors are embracing the “soft landing” narrative, but bond markets remain cautious, warning of growth headwinds. Positioning into Q4 favors defensives, quality AI infrastructure plays, and selective tech while keeping hedges against renewed volatility from Europe’s politics and US data surprises.

Side Commentary: What the Yield Curve Table Is Really Telling Us

While the Fed continues to warn about labor market fragility and keeps the door open for further rate cuts, the global yield curves tell a different story. The synchronized steepening across the US, UK, EZ, and even Japan suggests that markets expect growth and inflation to persist, not collapse. Historically, steep curves are seen near the start of economic expansions — not recessions.

The caveat: part of this steepening could reflect fiscal risk premiums — especially in the UK and US where deficits remain large — which means higher long-end yields aren’t purely bullish. If term premia rise too quickly (e.g., US 10Y > 5%), financial conditions could tighten and choke off growth.

Still, it’s worth thinking about whether the market has shifted from fearing recession to pricing a reflationary soft-landing, which might explain why equities remain near record highs despite mixed macro data. The Fed may be leaning cautious, but the bond market seems to be whispering: “the cycle isn’t over yet.”